Evaluation of the Indian Chartered Accountants Education for the U.S. CPA License

What goes into an education evaluation? Why is the process necessary for licensure in the United States? Aequo International is a wholly-owned subsidiary of the National Association of the State Boards of Accountancy and this month our Associate Director of Business Development and Research, Brentni Henderson, dives into the details of evaluating an education obtained in India for U.S. CPA licensure.

The Institute of Chartered Accountants of India (ICAI) was established in 1949 in an effort to standardize the chartered accountant profession. The entity serves as the national accounting organization for the profession in India. Various pathways exist for students to complete the preparatory program after high school or while completing a bachelor degree at a university recognized by appropriate accrediting organizations.

The Association of Indian Universities recognizes the final examination offered by ICAI as the equivalent or comparable completion of bachelor degree requirements for admission into master degree programs at many prestigious universities. In some cases, the qualification may be deemed as comparable to an Indian master’s degree and eligible for certain PhD programs.

ICAI assumes the following tasks: the administration of qualifying examinations, management of the Pre-Professional Foundation Course and Professional Course of Chartered Accountancy programs, coordination of Practical Training, awarding of Associate Membership to successful candidates (grants admission to Ph.D. programs in most Indian Institutes of Management and over 40 Indian Universities), awarding of Certificate of Practice and execution of Post-Qualification Diploma Courses in management accountancy, corporate management and tax management.

When considering comparative education and standards as it relates to the accounting profession in the United States, many factors must be considered. Regulatory boards are responsible for the licensure and oversight of certified public accountants (CPAs) and accounting firms in their respective jurisdiction. Many boards closely adhere to or have fully adopted the Uniform Accountancy Act (UAA), developed by the American Institute of Certified Public Accountants (AICPA) and the National Association of State Boards of Accountancy (NASBA). The UAA has outlined specific requirements for accountants regarding education, examination and experience for licensed CPAs. In addition, Mutual Recognition Agreements (MRA) have been established for international candidates who hold specific accounting designations in their home country. The AICPA and NASBA have established MRAs with the following entities: Institute of Chartered Accountants of Australia; Canadian Institute of Chartered Accountants; Chartered Accountants Ireland; Instituto Mexican de Contadores Publicos; New Zealand Institute of Chartered Accountants; Hong Kong Institute of Certified Public Accountants.

ICAI has established the following MRAs with institutes abroad including: The Institute of Chartered Accountants in England & Wales, the Institute of Chartered Accountants Australia, CPA Australia, the Institute of Certified Public Accountants in Ireland, the Hong Kong Institute of Certified Public Accountants, the Canadian Institute of Chartered Accountants, the Certified General Accountant Association of Canada, and Sri Lanka. In addition, ICAI has Memorandums of Understanding (MOUs) with the following organizations: University of Djibouti, Institute of Chartered Accountants Australia, College of Banking & Financial Studies in Oman, CPA Mongolia (Technical Assistance Program), Chinese Institute of Certified Public Accountants and the Center of Excellence, Research, and Training in Dubai, United Arab Emirates.

The MOUs and MRAs established by the Indian and American accounting professions have a significant impact on the evaluation of education, examinations completed and accounting experience required for licensure in the home country. The qualifications are not easy to evaluate. Evaluation standards for regulatory boards differ greatly from those of admission standards in the United States. While the international education evaluation industry standard for admission may be a three-year degree from India, a stand-alone three-year degree will not deem a candidate eligible for the U.S. CPA examination developed by the AICPA.

Thus, arriving at an educational equivalency requires a seasoned evaluator to consider more factors than you normally would for an academic admission into post-secondary programs. While ICAI is the standard for accounting education in India, and their graduates are highly specialized and trained (especially considering the amount of practicing experience required to receive the full designation), it is considered by many Boards of Accountancy to be professional education and thus does not qualify a candidate to sit for the U.S. CPA exam.

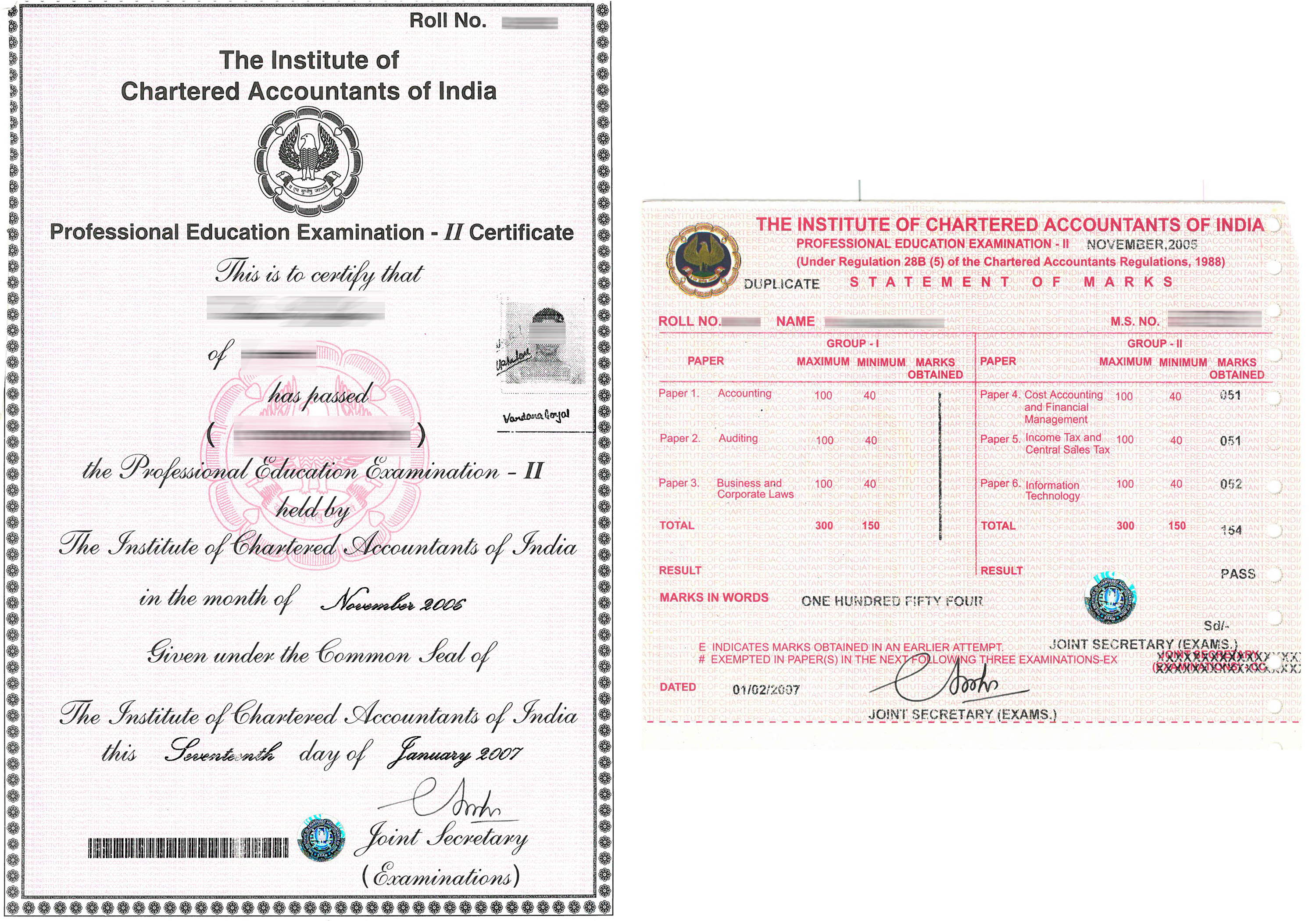

A sample of ICAI credentials

Evaluating a credential or examinations completed by ICAI candidates requires attention to detail in terms of education versus truly examination pathways. Prior to 2002, all professional education examinations offered by the ICAI were recognized as equivalent to academic study at the post-secondary level. Academic education programs may or may not be administered in the following years.

Examinations via Educational Tracks

Examinations where post-secondary academic credit should be awarded:

- Foundation Examinations

- Intermediate Examinations

- Final Examinations

- Professional Education I & II Examinations

- Integrated Professional Competence Examinations

- Professional Competence Examinations (only years 2010 – 2011)

- Information Systems Audit Course Examination

- International Trade Laws (ITL)/World Trade Organization (WTO) Part I

Examinations via Professional Tracks

Examinations where post-secondary academic credit should NOT be awarded:

The following certificate courses are not considered to be the equivalent of academic credit from a post-secondary institution:

Author: Brentni Henderson, Associate Director of Business Development & Research

Posted: October 24, 2016